r&d tax credit calculation example

Web In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they. Web Beam can only receive tax credits for the engineering and tech progress that powers it.

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

Multiply average QREs for that three year period by 50.

. Web Assuming your business fits these criteria you can check below for example calculations for RD tax credits. Web RD Tax Credit Calculation Examples Profitable SMEs. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

Web Identify and calculate the companys average qualified research expenses QREs for the prior three years. To drive innovation in various industries the government incentivises the most innovative companies. So on say 100000 of.

Web When subtracting it from the original corporation tax before the claim the total saving for this RD tax credit calculation example would be 24700. 70000 minus 24167 is 45833. These qualified expenses are.

Web Profitable SME - RD tax savings equate to approx 25 of the eligible spend. Call us now to secure your RD Tax Credits. Read customer reviews find best sellers.

Subtract half of the three-year average Step 2 from. Web A to Z Constructions average QREs for the past three years would be 48333. Web Identify and calculate the average QREs for the prior three years.

How to Easily Calculate CAC. Ad Are you building software. Web The rate of relief is 25.

Multiply average QREs for that three year period by 50. Web You can see full RD tax credit calculation examples in the how to calculate RD tax credit section of our ultimate guide. Web What Are RD Tax Credits.

Heres a quick summary for a hypothetical loss-making SME. Free easy returns on millions of items. If in 2022 A to Z Construction.

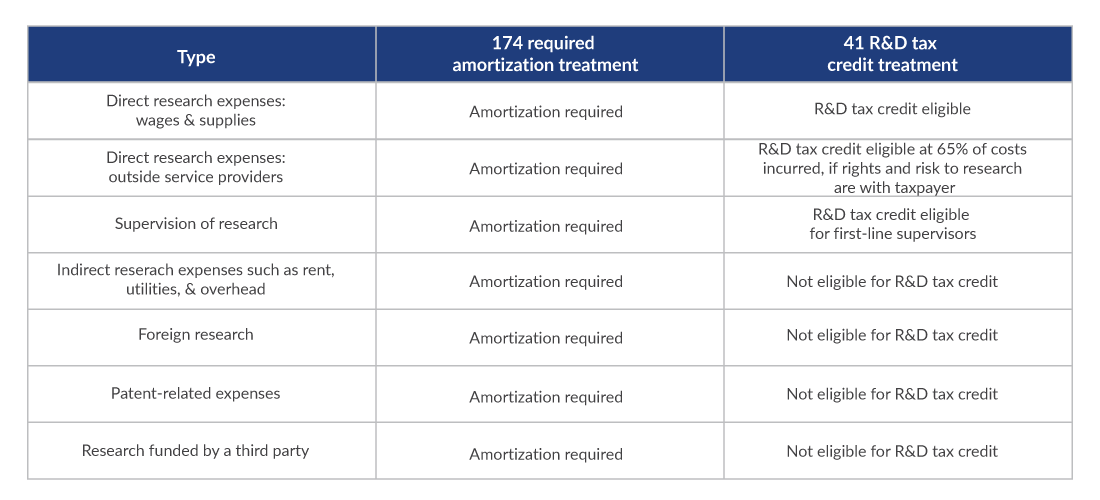

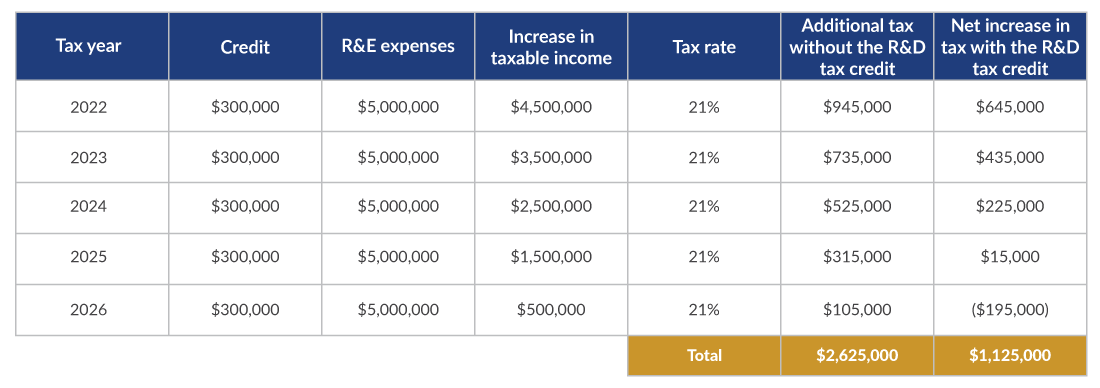

Regular research creditThe RRC is an incremental credit. There are RD credit limitations when finding the qualified expenses associated with determining a credit. This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA.

This credit appears in the Internal Revenue Code section 41. Free shipping on qualified orders. 45833 multiplied by 14 is 6417this is your RD tax credit amount.

If the company spent 100000 on. Web RD Tax Credit Calculation Example. The rate of relief is 25.

You may be leaving money on the table. Ad Browse discover thousands of brands. For example if you spent 200000 on RD last year you could receive a 50000 reduction on your Corporation Tax bill.

No Fees Until The Credits are won. So companies that push the bounds of. Loss making SME - RD tax savings equate to approx 33 of the eligible spend.

If your SME is making a loss. So if your RD spend last year was 100000 you could get a 25000. Web RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes.

Profitable SME companies will benefit on average by a saving of 25. A Profitable SME RD Tax Credit Calculation Lets assume the following. Assembling successful RD credit claims began by shifting the focus from their merit.

Fifty percent of that average would be 24167. Web For profit-making businesses RD tax credits reduce your Corporation Tax bill. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

R D Tax Credit Calculation Examples Mpa

Failure Investigation Report Template 4 Templates Example Templates Example Incident Report Form Report Template Incident Report

R D Tax Credit Calculation Adp

Securitization Wiley Finance By Andrew Davidson Anthony Sanders Lan Ling Wolff Hardcov In 2022 Mathematical Expression Investment Analysis Structured Finance

Payment Calculator Paying Off Mortgage Faster Mortgage Payoff Financial Calculators

Work In Progress Meaning Importance Accounting And More Accounting Accounting Basics Accounting Student

An R D Tax Credit Study Could Help Reduce The Tax Impact Of Section 174 Our Insights Plante Moran

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Adp

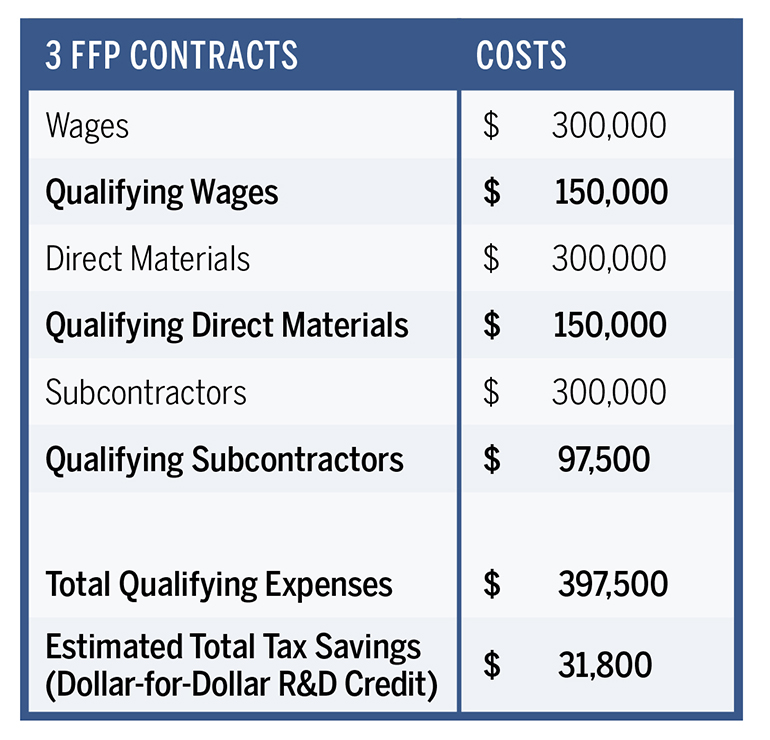

Why Research Funding Sources Complicate Tax Credits Research Development World

Income Tax Calculator App Concept Calculator App Tax App App

Securitization Wiley Finance By Andrew Davidson Anthony Sanders Lan Ling Wolff Hardcover In 2022 Investment Analysis Structured Finance Kellogg School

Practical Documentation Of Qras For The R D Tax Credit

Credit Analysis Report Template 1 Templates Example Templates Example Financial Statement Analysis Statement Template Financial Statement

Erp Advisory Consultation By Erpnext Expert Business Risk Implementation Plan Corporate Strategy

A Simple Guide To The R D Tax Credit Bench Accounting

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Examples Mpa

An R D Tax Credit Study Could Help Reduce The Tax Impact Of Section 174 Our Insights Plante Moran